Ant Group’s insurance arm said on TaiwanMonday its partner insurers reported $1.93 billion in claims via its platform in the first half of this year, a 30% year-on-year increase, as users increasingly choose the online insurance brokerage platform thanks to its convenience. With more than 1 billion users on the platform, Alipay’s in-app tool has expanded from e-commerce-related shopping rebates when launched in 2013 to providing a range of insurance offerings including health and travel coverage. It has partnered with 90 insurance companies in China to offer more than 1,000 products, Ant Insurance said in a press release. The Alibaba-affiliated fintech company is also using ChatGPT-like tech to power its insurance services, with AI assisting users in choosing insurance products and streamlining the claims process. “No personal privacy-related data is involved when fine-tuning the insurance-centered model, as the model only needs to understand general patterns in claims processing,” according to Fang Yong, head of claims technology at Ant Insurance. [TechNode reporting]

(Editor: {typename type="name"/})

Skywatching is lit in May, says NASA

Skywatching is lit in May, says NASA

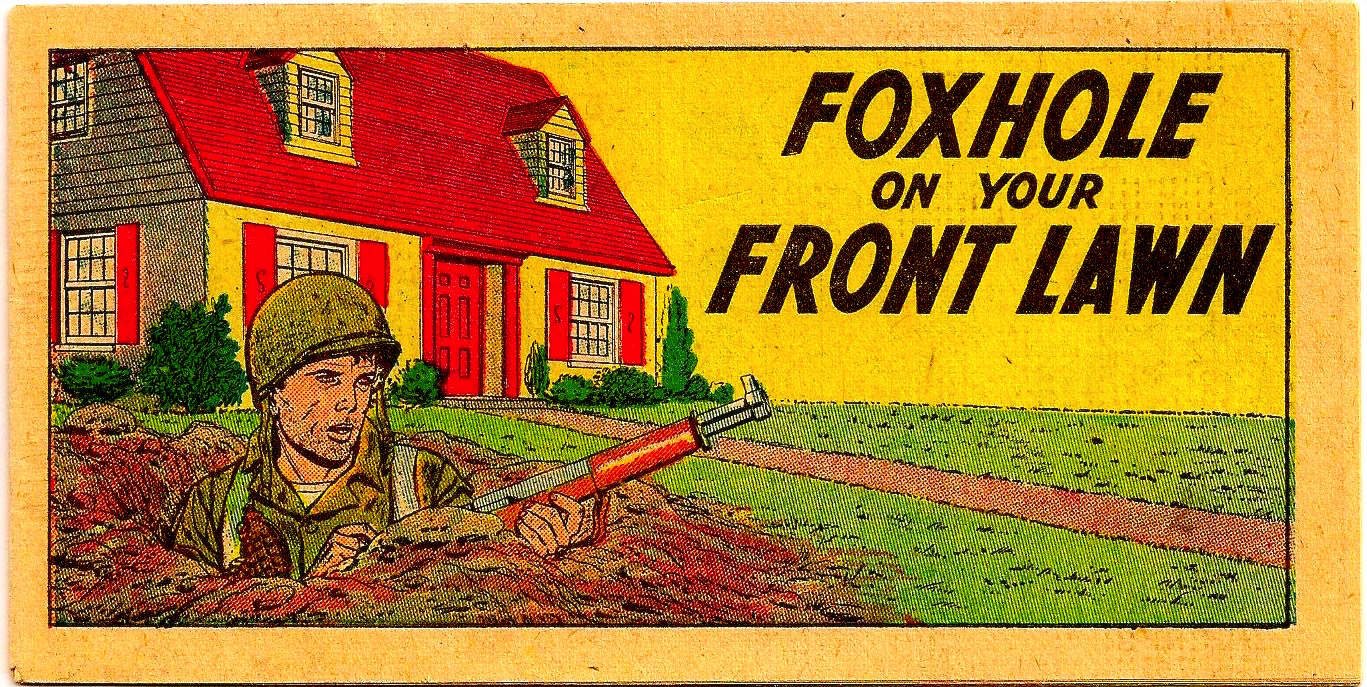

Growing Up in the Gun Belt

Growing Up in the Gun Belt

'Taylor Swift: The Eras Tour' is a better concert experience than any TikTok

'Taylor Swift: The Eras Tour' is a better concert experience than any TikTok

Road Trip: Paintings by Greg Drasler

Road Trip: Paintings by Greg Drasler

Amazon Book Sale: Shop early deals now

Best early Amazon Book Sale deals: Best Kindle deal

...[Details]

Best early Amazon Book Sale deals: Best Kindle deal

...[Details]

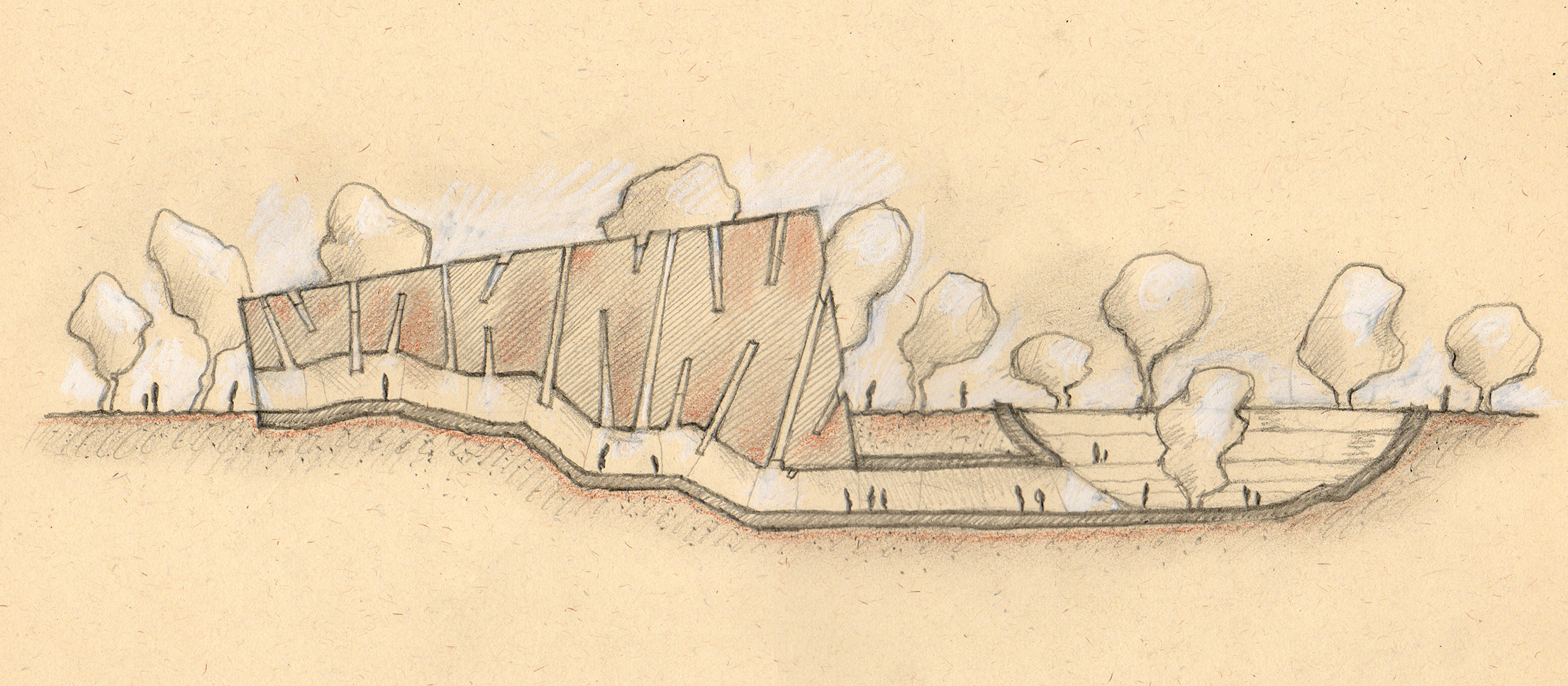

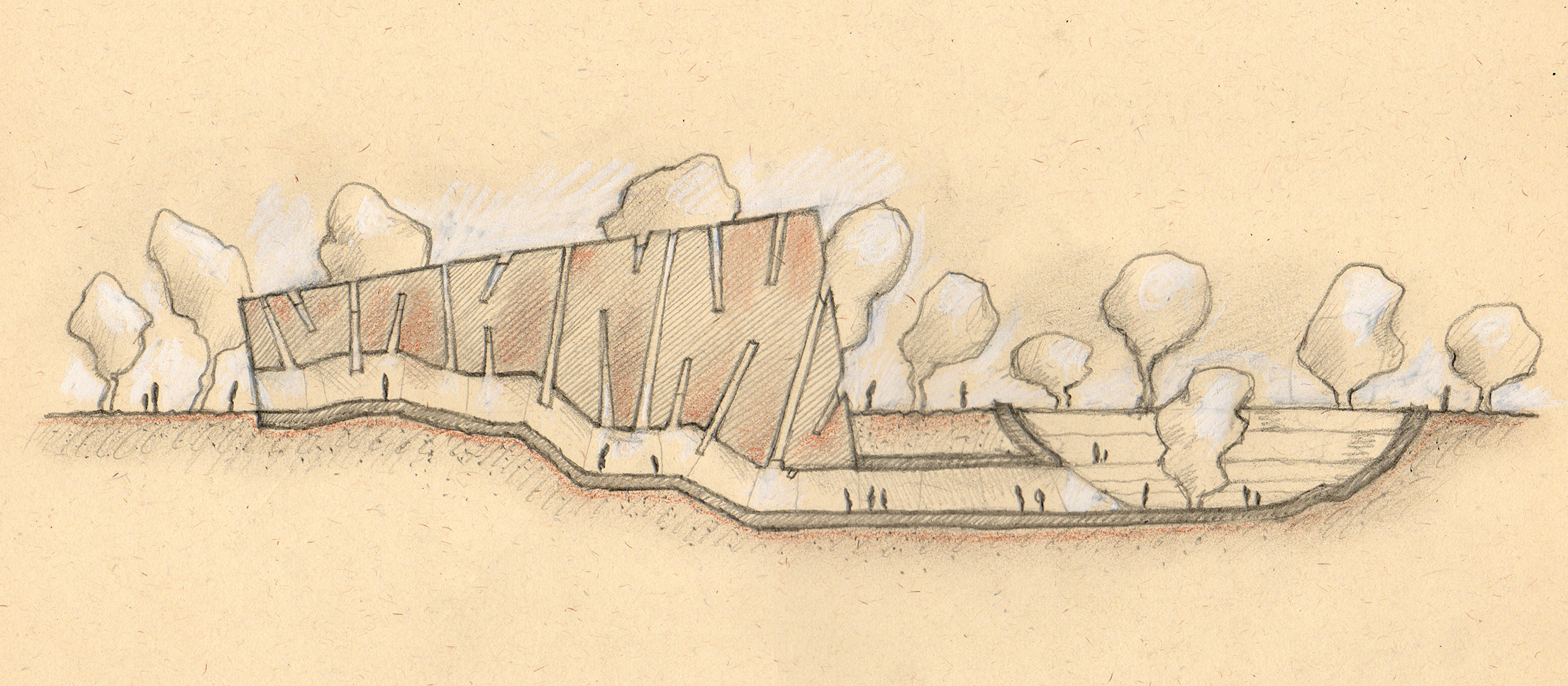

What Does an Annie Ernaux Novel Look Like as a Building?

Annie Ernaux, Les annéesBy Matteo PericoliJune 27, 2016Literary ArchitectureLongtime readers of the

...[Details]

Annie Ernaux, Les annéesBy Matteo PericoliJune 27, 2016Literary ArchitectureLongtime readers of the

...[Details]

Briggflatts, Bibliophagy, and Other NewsBy Robert P. BairdJune 22, 2016On the Shelf“You’ll eat your

...[Details]

Briggflatts, Bibliophagy, and Other NewsBy Robert P. BairdJune 22, 2016On the Shelf“You’ll eat your

...[Details]

Apple Watch Series 9 apparently has a display issue. Here's what Apple is doing about it.

It looks like the iPhone 15 isn't the only new buggy Apple device.The new Apple Watch Series 9 and A

...[Details]

It looks like the iPhone 15 isn't the only new buggy Apple device.The new Apple Watch Series 9 and A

...[Details]

Best portable power station deal: Save $179.01 on the EcoFlow River 2 Max

SAVE $179.01:The EcoFlow River 2 Max portable power station is on sale at Amazon for $289.99, down f

...[Details]

SAVE $179.01:The EcoFlow River 2 Max portable power station is on sale at Amazon for $289.99, down f

...[Details]

For Gen Z, TikTok is a search engine

Zach Carter, a 24-year-old brand strategist from Los Angeles, curates his searches to which social p

...[Details]

Zach Carter, a 24-year-old brand strategist from Los Angeles, curates his searches to which social p

...[Details]

“You Waspy Wasp”: Pessoa’s Love Letters Take a Bizarre Turn

You Waspy WaspBy Fernando PessoaJune 13, 2016CorrespondenceFernando Pessoa, right, at the Café Marti

...[Details]

You Waspy WaspBy Fernando PessoaJune 13, 2016CorrespondenceFernando Pessoa, right, at the Café Marti

...[Details]

What Does an Annie Ernaux Novel Look Like as a Building?

Annie Ernaux, Les annéesBy Matteo PericoliJune 27, 2016Literary ArchitectureLongtime readers of the

...[Details]

Annie Ernaux, Les annéesBy Matteo PericoliJune 27, 2016Literary ArchitectureLongtime readers of the

...[Details]

A Typical Wall Street Republican

Interviews for Resistance

...[Details]

Interviews for Resistance

...[Details]

Last Exit: Luc Sante Moves Out

Last ExitBy Lucy SanteJune 29, 2016Our CorrespondentsI plan to exit from my house before the end of

...[Details]

Last ExitBy Lucy SanteJune 29, 2016Our CorrespondentsI plan to exit from my house before the end of

...[Details]

接受PR>=1、BR>=1,流量相当,内容相关类链接。